MY DAY AT THE ‘ROTARY’ LEGAL-TAX SEMINAR 2022

Last month I had the opportunity to attend a legal-tax seminar in the municipality of Torrevieja, carried out by the Rotary organization.

Several experts in their respective fields attended the seminar of Rotary organization to talk about the most recent legal-tax developments. They spoke about many subjects and informed me of many updates, which added value to my knowledge. For this very reason, I would like to share with you the most important points that I think you should also know. Although it is always advisable that you go to experts like us to help and guide you with tax or legal issues, it is always good to have a minimum idea about the matter and, at least, to have an understanding of what we will be talking about.

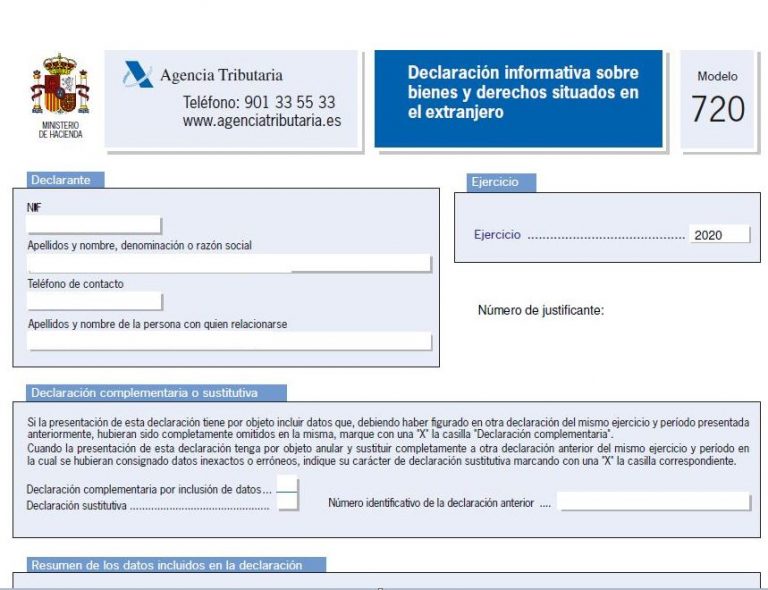

Model 720. Regulations on penalties.

I would like to start with the model 720, informative declaration to the Tax Office of the assets that you have abroad. This form must be submitted by residents in Spain who own assets abroad if they exceed a minimum value. Well, in Spain it’s always been a declaration feared by taxpayers because, although it is a declaration in which you do not have to pay any tax (it is only informative), the fines were HUGE, in case of any data omission or information being wrong.

Well, in January of this year 2022, a judgment by the Court of Justice of the European Union declared this sanctioning normative as unconstitutional and, finally, this is now regulated. Although THE MODEL 720 HAS NOT ABANDONED US, its sanctioning normative is now not as brutal and is equal to any other informative statement. Also, now it prescribes at 4 years, since before it did not even prescribe. (Yes, you are reading it correctly, if you commit a criminal offense it does prescribe, and this information statement did not prescribe, it was crazy…)

Cryptocurrencies.

It seems that cryptocurrencies are something that everyone is talking about, and it sounds distant, something from the future, but we cannot fool ourselves, as soon as we least expect it, they will be there, and they will come to stay with us forever. Therefore, we cannot bury our heads in the sand, and we must update ourselves and have an idea of how everything will work when they are normalised. Also, among many other things, it will be necessary to declare the possession of cryptocurrencies in the 720 model that we have also talked about if they are held outside of Spain. But of course, the complicated thing will be how to know exactly when it is considered that you have them outside of Spain, or to know through whom I operate. For this we will have to wait for the exact Regulation of its taxation.

As for the income tax declaration, like any other asset, nothing will have to be paid only for their possession, but in the case of capital gains from cashing them in, for example, you will have to pay.

Capital Gain Tax “Plusvalía”. New Regulation.

The tax on the increase in value of urban land (“Plusvalía“) has always been considered an unfair tax, since it was always assumed that there was an increase, and the reality is that there wasn’t always.

On October 26 of last year (2021), a sentence was declared where this tax was declared unconstitutional and finally, on November 6, a new method of calculating this tax was approved.

The first thing to consider is that there is not always a profit and, also, the coefficients for the calculation will be updated according to the evolution of the real estate market, so we will have the option of being able to calculate it in two ways.

There are two methods of calculating the Tax:

1.- One of them as it has been done until now, in an objective way and applying some coefficients to the cadastral value of the land,

2.- And another of them the real method, using the real values of acquisition and transmission.

In most cases, the existing way of calculating it is still more favorable, but not in cases where there is gain. However, the Administration will always give us the option of being able to calculate the tax using both methods and choose the most favorable for us, indicating it to the Administration which liquidation we prefer.

In addition, if you don’t have any profit, we can directly declare the sale to the Tax Office without profit and in this way the liquidation will not be issued. This way we avoid having to file a claim or an appeal once it is already issued, as we had to do before.

So no gain no tax to pay.

Let’s see, quickly, the calculation method of both forms:

-Objective method: Tax Base = Land Cadastral Value x Coefficient (established by regulations depending on the years of ownership of the property)

-Real method: Tax base = % Land Value x Profit

Finally, we will apply a coefficient established by each City Council to this tax base, with a maximum of 30%.

Something quite curious and interesting is that all the capital gains that were pending liquidation before November 9, liquidated without notifying, or appealed and unresolved, have been affected by the ruling and have been annulled or not liquidated, because they remain in a period of legal vacuum until the new regulations were approved.