Spain’s vibrant community of 3.3 million ‘autónomos’ is set to navigate several noteworthy changes in the coming year, spanning amendments to social security contributions, VAT regulations, and income tax reporting requirements.

Social Security Contributions:

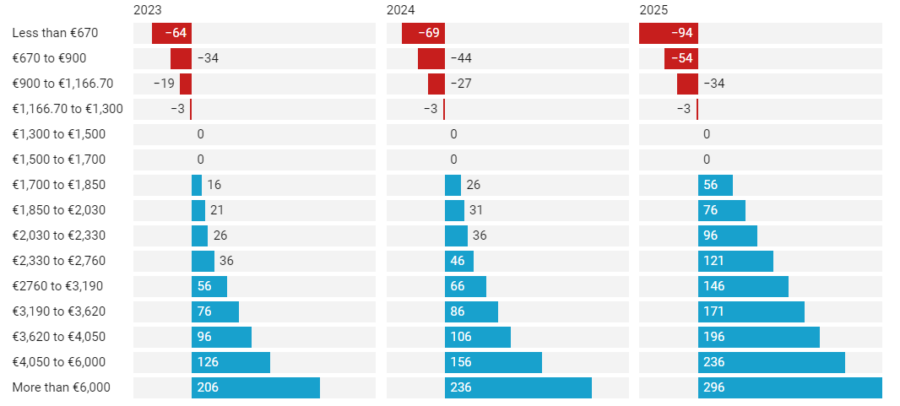

In a continuation of the reforms introduced in 2023, social security payments will remain tied to actual earnings rather than a fixed amount for all individuals. In 2024, these payments will see further adjustments, favouring those with lower incomes while increasing for higher earners.

The difference in social security payments for the self-employed in Spain going forward

Notably, individuals earning €1,300 or more per month will experience a reduction in their social security fees, ranging from €3 to €10 per month. Conversely, those earning over €1,700 monthly will witness an increase between 2.5% and 6%. For instance, a self-employed individual with a monthly income of €2,030 can expect a €10 monthly increase in their social security payments in 2024.

VAT Reporting Changes:

Collaborative efforts between self-employed associations and the Treasury are underway to align with European Directive 2020/285, which eliminates the quarterly VAT reporting requirement for self-employed workers earning less than €85,000 annually.

The European Union mandates full implementation by January 2025, with the transition commencing in 2024. During this period, self-employed workers will have the option to forgo VAT invoicing, and those earning under €85,000 can choose between the existing general VAT regime or the new special franchise regime.

Zero Social Security Payments in Select Regions:

Starting in 2024, newly registered self-employed workers in the Canary Islands, Extremadura, and Galicia will join their counterparts in regions such as Madrid in benefiting from a waiver of initial social security payments.

The Canary Islands will fully subsidize 100% of Social Security contributions for the first two years, with the possibility of an additional year for those earning less than the Minimum Interprofessional Wage (SMI) who meet specific criteria.

Extremadura offers an annual aid of €960 for social security contributions, contingent upon maintaining business operations in the region for two years and meeting certain eligibility criteria. Galicia will provide 100% subsidy for social security payments during the first year to approximately 10,000 new self-employed workers in the region.

Income Tax Returns: In 2024, a new regulation will require all self-employed workers to file their Income Tax Return, known as the “Declaración de la Renta,” irrespective of their income level. Unlike the current threshold of an annual net income equal to or exceeding €1,000, this mandate will apply universally, encompassing all self-employed individuals, even those with lower earnings or who have incurred losses in a given year.

Digital Improvement Funding:

Commencing in the upcoming year, Spain’s Kit Digital will become accessible to communities of property owners and civil societies. These kits offer vouchers to facilitate various digital operations, including website development, marketing campaigns, and social media initiatives.

Eligible for application are civil companies with a commercial purpose and communities of property owners with up to 50 employees, provided they meet the general requirements of the Digital Kit Program. The application deadline for this opportunity is December 31st, 2024.

Delay in Mandatory Digital Invoicing:

Despite the approval of Spain’s Create and Grow Law in September 2022, which mandates the issuance of electronic invoices for self-employed workers and small businesses, implementation has been delayed, partly due to early elections this year.

Self-employed workers and companies with annual turnovers exceeding €8 million will have one year to transition and comply with this requirement.