THE ESCALATION OF PRICES IN SPANISH MORTGAGES

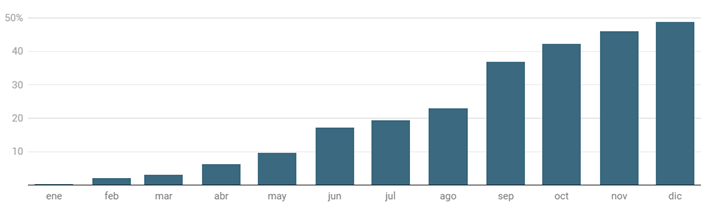

The escalation of the Euribor, the majority reference rate for mortgages granted in Spain, has gone from -0.477% in January 2022 to 3,018% on December 2022, which has caused a significant change in the mortgages granted by Spanish credit institutions.

Evolution of Euribor 2022:

Fixed interest or variable?

Although, before this increase it was much more common to apply for variable interest mortgages, with a differential based on the Euribor, before the continued escalation of the reference rate, there has been a change towards the application of fixed rate mortgages. The current percentages vary depending on the entity from 3.20% to 4.50%, to which some bonifications can be applied by contracting additional products.

Given the decline in mortgage applications with variable interest, some entities have chosen to reduce the differential to make them more attractive. According to data from the portal specialized in financial products, Helpmycash, the offers in December 2022, had an interest from 0.6% plus Euribor, with one more point if the additional products are not contracted, being Euribor + 1.60% in these cases.

Given the decline in mortgage applications with variable interest, some entities have chosen to reduce the differential to make them more attractive. According to data from the portal specialized in financial products, Helpmycash, the offers in December 2022, had an interest from 0.6% plus Euribor, with one more point if the additional products are not contracted, being Euribor + 1.60% in these cases.

What is the forecast for the evolution of the Euribor for the year 2023?

The Euribor depends indirectly on the interest rates set by the European Central Bank. This had been neutral or negative since 2014 for some sections, although it is now at 2% for the general rate. Therefore, the more the interest rate rises, the more the Euribor will also rise.

The market forecast is that during the first semester of the course it will be on the rise, so that afterwards there will be a moderation and possibly a small drop from the second semester.