Spain’s New Crypto Declaration Form

Explaining Modelo 721: Spain's Fresh Approach to Reporting Crypto Holdings

Spain has introduced a new regulatory measure aimed at monitoring crypto assets held overseas by its residents. Here’s a comprehensive breakdown of the new form and who falls under its filing requirements.

The Modelo 720 is the standard declaration form individuals submit to Spanish tax authorities to disclose assets held abroad exceeding €50,000.

This year, the Spanish government has extended this requirement to cover crypto assets specifically, introducing the Modelo 721.

Similar to the Modelo 720, the deadline for filing Modelo 721 is March 31st, drawing near. Continue reading to determine if you are obligated to file.

Additionally, two new forms, Modelos 172 and 173, have been introduced for crypto platforms and exchanges. However, these are solely applicable to platform operators and not to individual crypto holders.

While some might argue this contradicts the anonymity inherent in cryptocurrencies, Spain views it as a measure against money laundering and fiscal evasion.

Furthermore, it serves as a means to gauge the extent of individuals’ crypto holdings, facilitating future tax assessments on crypto sales, which are taxable in Spain.

The Modelo 721 applies to both Spanish citizens and legally resident foreigners solely for informational purposes. Individuals are not expected to pay taxes on overseas assets but may face penalties for failing to report them.

Who is required to complete Modelo 721?

Similar to Modelo 720, it applies only to assets valued at €50,000 or more. Given the volatile nature of crypto asset values, declarations must reflect holdings as of a specific date.

This date is December 31st of the preceding year, in this case, December 31st, 2023. Thus, if your crypto holdings exceeded €50,000 on that date, you must file the form.

Regarding crypto held in foreign exchanges:

Modelo 721 pertains exclusively to assets held abroad, excluding those within Spain. This includes cryptocurrencies held in foreign exchanges, where individuals buy and sell digital assets.

In 2021, the Bank of Spain approved a decree mandating cryptocurrency exchanges operating in Spain to register with the bank and comply with anti-money laundering regulations.

Presently, approximately 70 exchanges are registered with the Bank of Spain, including Binance, Bit2Me, BitPanda, Criptan, Bitbase, and Bitonovo.

Therefore, individuals with crypto assets stored in these registered exchanges are exempt from filing Modelo 721, as these assets are not considered foreign holdings.

Regarding crypto assets held in wallets:

Many individuals opt to store their crypto assets in personal wallets rather than exchanges. These wallets, residing on personal devices like computers, are considered within Spain, exempting holders from Modelo 721 filing requirements.

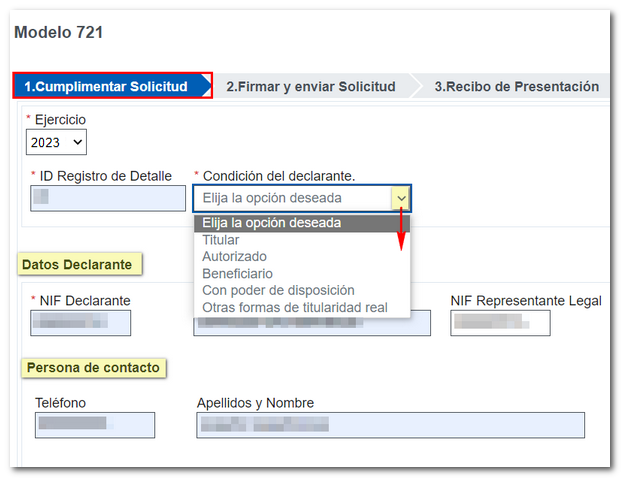

What information do I need to provide for Modelo 721?

- Your name or company name (if applicable).

- Fiscal identification number (NIF), akin to NIE.

- Your address.

- Details of all owned cryptocurrencies.

- Quantity of each cryptocurrency held and their corresponding Euro value as of December 31st, 2023.

Official documentation verifying this information, such as transaction statements, may be required.

What if I’m uncertain about filing Modelo 721?

If you seek guidance from a gestor, they might advise filing Modelo 721 based on your crypto holdings. However, due to the novelty of these regulations, gestores unfamiliar with crypto might err on the side of caution.

In such cases, consulting a specialized crypto lawyer in Spain can offer clarity and prevent unnecessary filings.

Do I report crypto profits on this form?

No, Modelo 721 is purely informative. Profits from crypto transactions must be declared separately, usually on the annual declaración de Renta.

If you still have doubts, please have no hesitation contacting in contacting our crypto advisor Inés. She can be contacted directly at ines@sgmlegalspain.com