How to Apply for Spain’s Beckham Law

Discover the Game-Changing Beckham Law: Your Ticket to Lower Taxes in Spain!

Uncover the secrets of Spain’s tax haven for expats with our comprehensive step-by-step guide on how to leverage the powerful Form 149.

This remarkable tax regime, famously dubbed the Beckham Law after the legendary footballer David Beckham, who pioneered its benefits upon joining Real Madrid, is officially known as the Régimen Especial de Trabajadores Desplazados o Impatriados.

Become a part of the league of ‘inpatriates’, international professionals strategically positioned in Spain to propel their careers to new heights.

Unlock the Beckham Law’s extraordinary advantage, granting you the ability to pay taxes in Spain at non-resident rates for an incredible six years, all while enjoying the vibrant Spanish lifestyle.

Picture this: a flat tax rate of just 24 percent, applicable up to €600,000, giving you unparalleled financial freedom and peace of mind.

How to Apply for Beckham’s Law: A Step-by-Step Guide

Unlocking the benefits of Beckham’s Law is a game-changer, but remember, it won’t happen automatically. You need to take action and apply for it. This is where Modelo or Form 149 comes into play.

Timing is crucial here. Make sure you complete this process within the first six months of your residency in Spain. Missing this window means missing out on the fantastic tax advantages.

You’re eligible to complete this form if:

- You haven’t been a resident in Spain in the last five years.

- You moved to Spain for work, either with a Spanish employer or by working remotely for a company based outside Spain.

- You’re not self-employed, unless your venture is innovative and of significant financial interest to Spain, backed by a favorable report from the General State Administration.

To fill out Modelo 149, head online. But first, you’ll need to identify yourself using a digital certificate or a Cl@ve pin.

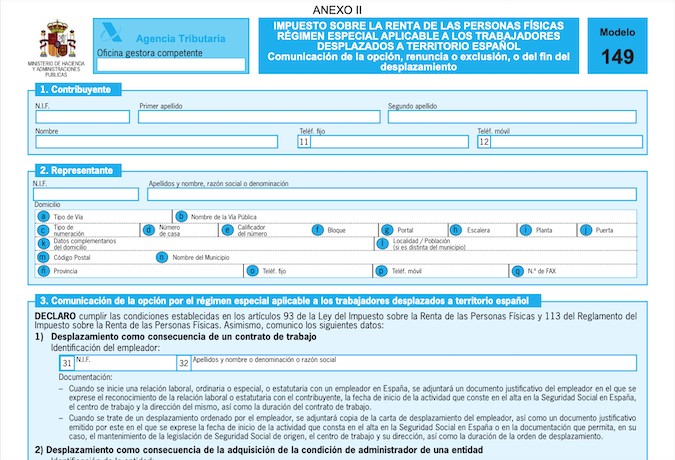

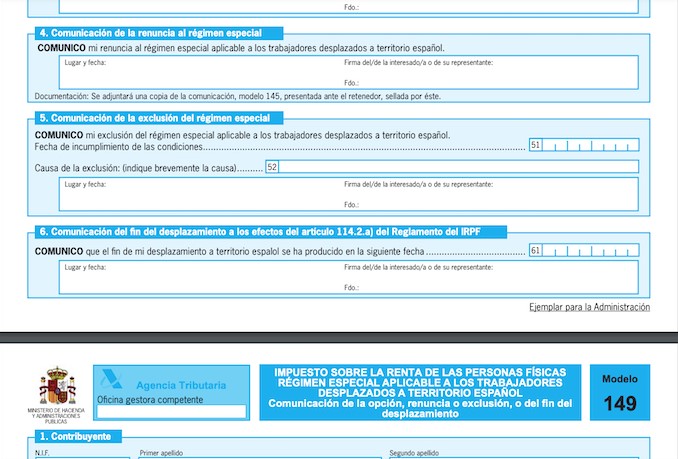

Section 1

This is where you provide your personal details: NIE/NIF, name, and phone number.

Section 2

This section is for details of any professional assisting you with the form. If you’re handling it yourself, feel free to skip this part.

Seize this opportunity and take charge of your tax advantages today! Don’t let this window of opportunity close without reaping the benefits. Apply now and secure your financial future in Spain.

Section 3: Stating Your Case for Beckham’s Law

This is where you make your case for Beckham’s Law. You have two options:

‘Desplazamiento como consecuencia de un contrato de trabajo’: Choose this if you’ve relocated to Spain due to a work-related transfer.

‘Desplazamiento como consecuencia de la adquisición de la condición de administrador de una entidad’: Opt for this if your move to Spain is a result of your company being acquired, necessitating your relocation.

Within these categories, provide the specific details that pertain to your situation:

- Your NIE

- Date of entry into Spain

- Commencement date of social security payments

- Country of origin

Being precise in this section ensures that you’re on the right track to unlocking the full benefits of Beckham’s Law.

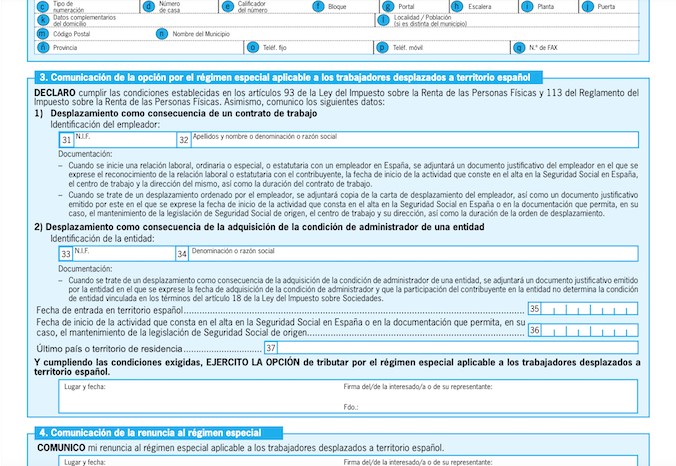

Sections 4 and 5: Leave Blank if Applying for Beckham’s Law

When applying for Beckham’s Law, sections 4 and 5 remain untouched.

Section 4: This is for those who wish to renounce their special tax regime.

Section 5: For those who no longer meet the conditions of the law and must relinquish it. This may occur if, for instance, there’s a change in your employment situation.

Section 6: For Contract Completion and Return Home

This final section is designed for individuals who have fulfilled their contract in Spain and are on their way back to their home country. If this doesn’t apply to you, feel free to skip it.

Streamline your application process for Beckham’s Law and focus on the sections that matter most to your situation. This way, you’ll make the most out of this incredible tax regime. Don’t let paperwork stand in the way of your financial advantage! Apply now.

Submitting your form

When you are done, click on ‘Validar declaración‘ or ‘Validate declaration’ to check if there are errors. The list of errors and warnings detected will be displayed, allowing you to correct it by clicking on the ‘Go to error’ button next to the description.

If no errors are detected, you can file the return. You will do this by clicking on ‘Firmar y Enviar‘ or ‘Sign and Send’.

If everything is correct, you will get the response sheet that says ‘Su presentación ha sido realizada con éxito’ or ‘Your submission has been successfully completed’ with a PDF to download a copy of the form.

Additional documents

Along with your form, you will have to attach a copy of your employment contract with a Spanish company, your Social Security number, a copy of your passport and your foreign identification document such as TIE or EU green residency card.

Receiving a response

The law states that you should receive a reply to see if you’ve been successful or not within a period of 10 working days, however, in reality, it can take more like one or two months to receive an answer.

Once Beckham’s law has been applied to you, if you keep meeting the requirements, you can benefit from it for up to six years. Each year you must declare your taxes using Modelo or Form 151.