Do I need to Complete a Modelo 720?

What is the 720 form?

The “Modelo 720” form, is a a declaration of assets abroad for resident people in Spain.

Spanish tax residents are obliged to fill out this 720 tax form and make the tax authorities (“Hacienda”) aware of their assets abroad.

Do I need to submit a 720 form?

All physical persons resident in Spain who own assets outside of the country with a total value of more than 50,000 euros on 31st December of the previous year must submit Form 720. This includes the following assets:

- Bank accounts in financial entities.

- Investments, Private pensions, life insurances.

- Properties

Fiscal residents in Spain are also obliged to declare any representatives, beneficiaries or people who have power of attorney over those assets.

If the sum total of any of the three groups mentioned before does not exceed 50,000 euros, you don’t have to declare these overseas assets.

When and how to submit the form 720 in 2022?

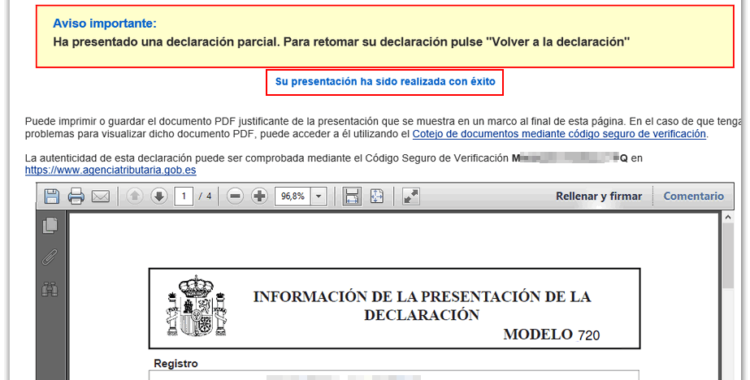

This declaration of your overseas assets must be submitted online, so you can only file the Form 720 electronically and not in person, with a digital certificate.

It must be submitted between 1st January and 31st March of the year following that for which the information must be reported. This means that your declaration of assets held outside of Spain in the year 2021 must be filed before the 31st March 2022.

What happens if I don’t file the Modelo 720 form?

If you miss the deadline however, the fines are costly and there are severe penalties for failing to correctly report all your overseas assets with the form 720. Although the declaration of overseas assets is merely informative and not a Tax collection, there are very high penalties, for late submission, giving false information or an incomplete submitted declarations.

The penalties go from 100€ per detail with a minimum of 1.500€ for late submission to 5.000€ per detail with a minimum of 10.000€ for not submitting or submitting with incorrect details.

However, it should be pointed out that on 2019, the European Union has considered Spain to be breaking EU law with these sanctions. While these penalties still apply at the moment in 2022, the European Commission is currently in the process of bringing legal proceedings against the Spanish Hacienda Tax authorities against the illegality of such fines.

Due to the complexity of the forms and the fines involved, you would need a fiscal adviser, to submit the form properly on your behalf, if you are entitled to it.